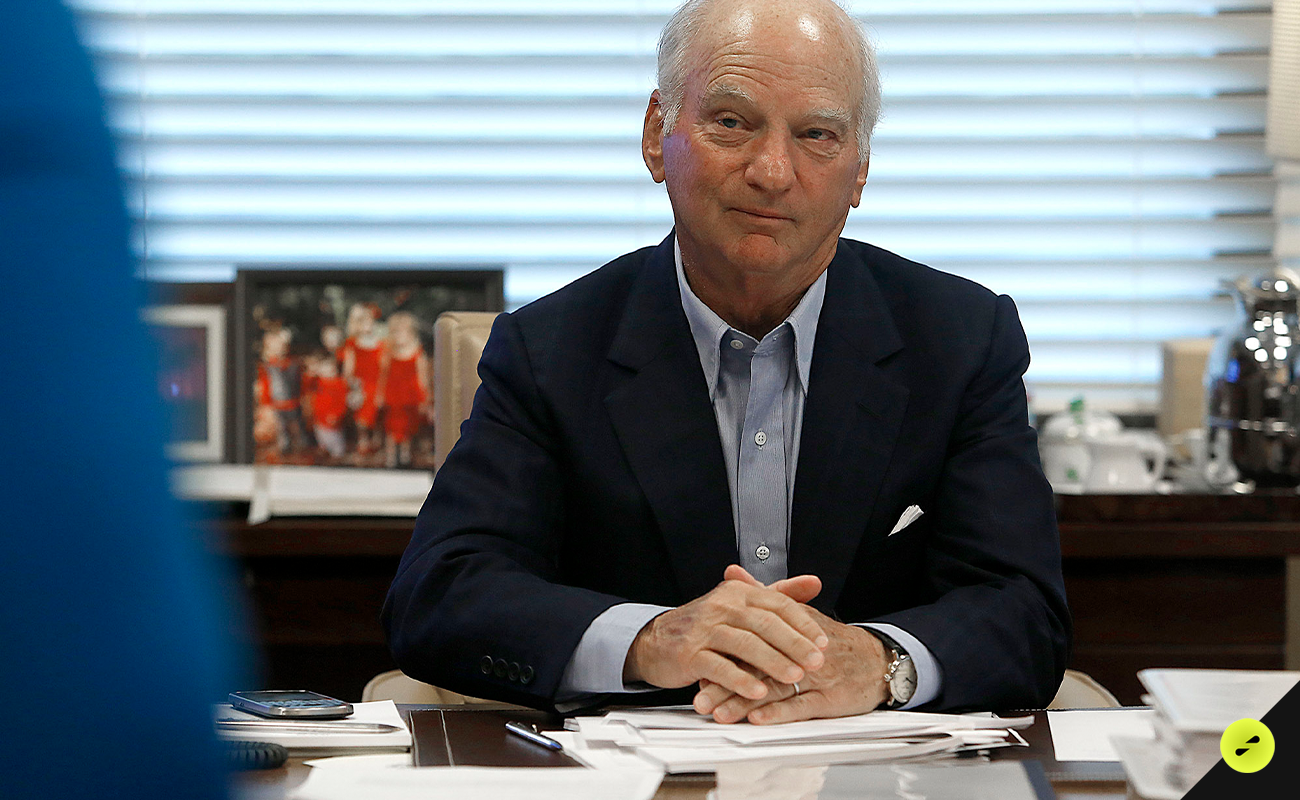

George Roberts, a trailblazing American financier, has left an indelible mark on the world of finance. Co-founder of the renowned Kohlberg Kravis Roberts (KKR), George Roberts’ journey is a testament to his unwavering commitment to innovation and philanthropy. At Zatrun.com, we delve into the remarkable life and career of this financial luminary.

George Roberts: Early Life and Education

George Roberts was born into a Jewish family in the vibrant city of Houston, Texas, in 1943. His educational journey began at Culver Military Academy, where he graduated in 1962 and was later honored with the “Man of the Year” Award in 1998. Roberts pursued higher education at Claremont McKenna College, completing his undergraduate studies in 1966. He further honed his intellect and skills at the University of California’s Hastings College of the Law, earning his degree in 1969.

Roberts commenced his professional career at Bear Stearns during the late 1960s, steadily ascending the ranks and achieving the prestigious title of partner by the age of 29. It was during his tenure at Bear Stearns that the seeds of financial innovation were sown. Collaborating with Jerome Kohlberg and Henry Kravis, Roberts embarked on a series of investments that they aptly termed “bootstrap” investments. Their acquisition of the Orkin Exterminating Company in 1964 marked one of the pioneering leveraged buyout transactions.

Over the following years, this formidable trio completed a series of acquisitions, including Stern Metals (1965), Incom (a division of Rockwood International, 1971), Cobblers Industries (1971), and Boren Clay (1973). Their successful investment portfolio also included Thompson Wire, Eagle Motors, and Barrows through their involvement with Stern Metals. However, they did face setbacks, notably the bankruptcy of the $27 million investment in Cobblers.

By 1976, the rift between Bear Stearns and the trio of Kohlberg, Kravis, and Roberts had reached a breaking point, leading to their departure and the establishment of Kohlberg Kravis Roberts (KKR). Notably, a source of tension had been Bear Stearns’ reluctance to create a dedicated investment fund.

Early investors in KKR included Henry Hillman. By 1978, KKR had achieved a pivotal milestone by successfully raising their first institutional fund, supported by investor commitments. Roberts’ financial acumen and strategic investments have propelled his net worth to an estimated $5.9 billion as of 2018.

A Life of Philanthropy and Influence

Beyond his accomplishments in finance, George Roberts has channeled his success into philanthropy and public service. He serves as the founder and chairman of the boards of directors of non-profit organizations like the Roberts Enterprise Development Fund (REDF), focusing on job creation. Additionally, he holds positions as a trustee of Claremont McKenna College and Culver Military Academy, and as a board member of prominent institutions like the San Francisco Symphony, San Francisco Ballet, and the Fine Arts Museum.

Roberts’ commitment to education and philanthropy was evident in his 2012 donation of $50 million to Claremont McKenna College, further strengthened by his generous $140 million donation to CMC in 2022. George Roberts’ journey is a testament to the transformative power of finance, education, and philanthropy, making him an influential figure in both the financial and philanthropic realms. At Zatrun.com, we celebrate his remarkable achievements and his lasting impact on society.