Franco Modigliani 101: Who is the Italian Economist? In our article of Zatrun.com, we will cover in detail everything you need to know about the Italian economist Franco Modigliani that our readers are curious about.

Who is Franco Modigliani?

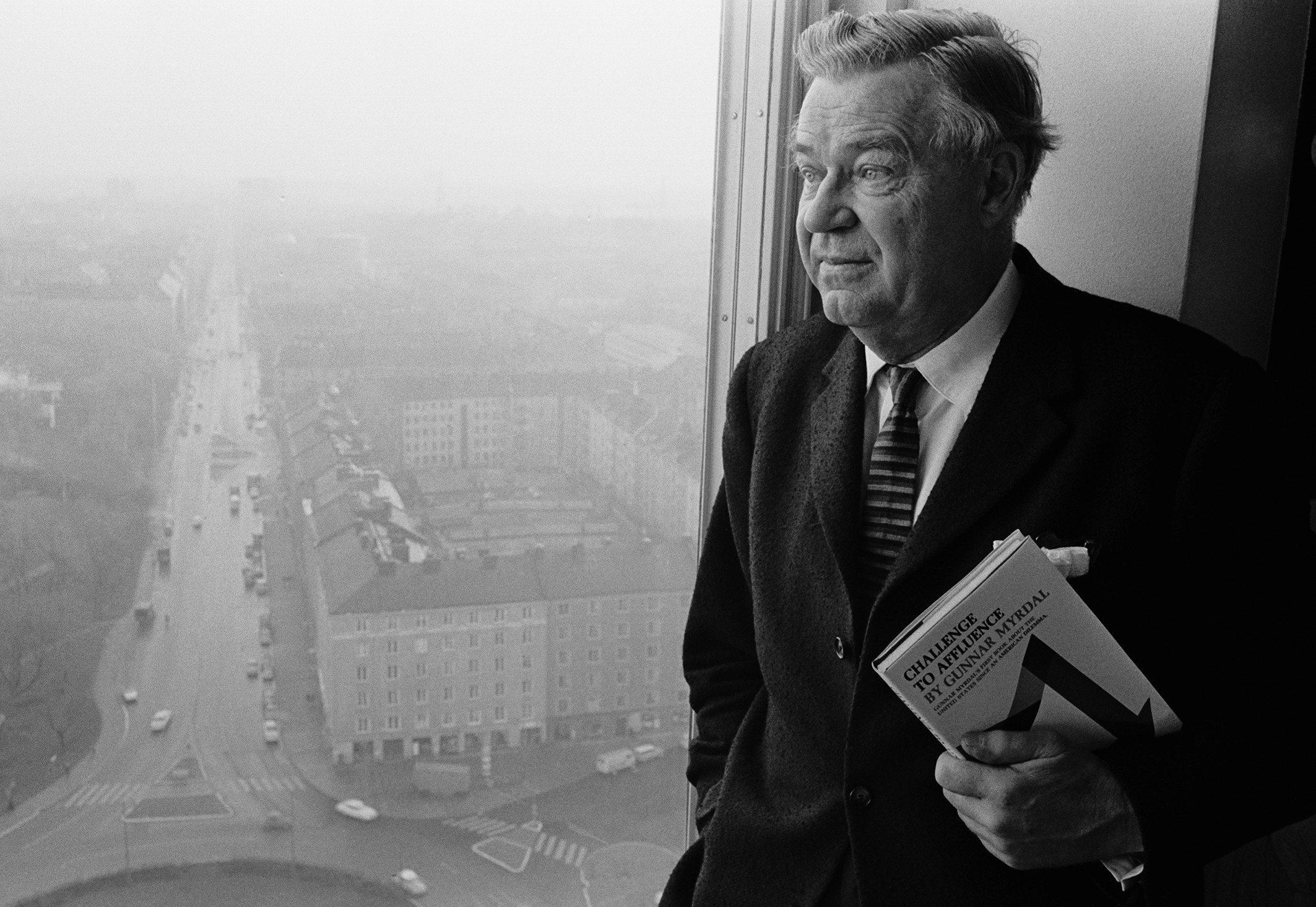

September June 18, 1918, Rome, Italy – September 25, 2003, Cambridge, Massachusetts, USA), Franco Modigliani, is an Italian-born economist who became a U.S. citizen in 1946. Modigliani received his economics degree from La Sapienza University of Rome.

He left Italy in 1939 and immigrated to the United States because of his anti-fascist views and Jewish heritage. He taught economics and statistics at Columbia University and Bard College in New York City from 1942 to 1944. He received his Ph.D. from the New School for Social Research in New York City in 1944, where he studied under Jacob Marschak.

Franco Modigliani became a U.S. citizen in 1946 and was appointed professor of economics at the University of Illinois at Urbana-Champaign in 1948. He then taught at the Institute of Industrial Management at Carnegie Mellon University from the 1950s to the early 1960s.

Franco Modigliani joined the faculty of the Massachusetts Institute of Technology (MIT) as a full-time professor in 1962, where he remained until his death. Modigliani was awarded the Nobel Prize in Economics in 1985 for his work on macroeconomic theory and monetary policy. He died on September 25, 2003 in Cambridge, Massachusetts.

Contributions to the Economics

Franco Modigliani is a well-known economist who has made significant contributions to the field with two new ideas in the field of economics. His first contribution was the life cycle hypothesis, which describes the total volume of savings in an economy. According to this hypothesis, individuals aim to maintain a stable level of consumption throughout their lives in an economy.

Therefore, when individuals first enter the workforce, instead of saving and borrowing, they start to accumulate savings to cover their debts as their careers progress, and they create capital to meet their consumption needs during retirement. Finally, they consume their savings during their retirement years.

Together with another American economist, Merton Miller, Modigliani introduced the Modigliani-Miller theorem on corporate finance. According to this theorem, assuming that certain but realistic assumptions are met, in terms of the impact on the value of a company, there is no difference between using the method of selling shares to finance production and borrowing from the market to obtain financing.

Modigliani’s life cycle hypothesis is a ground-breaking concept in economics, providing insight into individuals’ saving behaviours over time. By understanding how individuals’ savings change over time, policymakers can make better decisions to encourage saving and promote economic growth.

Modigliani-Miller Theorem

On the other hand, the Modigliani-Miller theorem has important implications for corporate finance. Companies can choose between selling shares or borrowing to finance production without affecting their value. This gives companies more flexibility in choosing financing methods and can lead to greater efficiency in capital allocation.

As a result, Modigliani’s contributions to economics have had a significant impact on this field and have influenced economists’ approaches to savings behaviour and corporate finance. His ideas continue to be studied and implemented today, and his legacy will undoubtedly continue to shape the field of economics in the coming years.